CONNECTIVITY IS CAPITAL

The cost and constant need for capital in the telecommunications industry has been a challenge as some of these assets need to be amortized over an operational period longer than 30 years. This has led to oligopolies with the incumbents and have led to important social challenges such as the digital divide and rural connectivity. The expectations of stock and corporate performance are often incompatible with the nature of these assets. Similar to water systems, power systems, railroads and roads, digital infrastructures are the backbone of tomorrow’s economy with digital goods and services that will touch all aspects of our lives. This is why Digital Ubiquity believes that projects will continue to be a mix of public and private partnerships at different levels.

SHARED PROJECT VALUE?

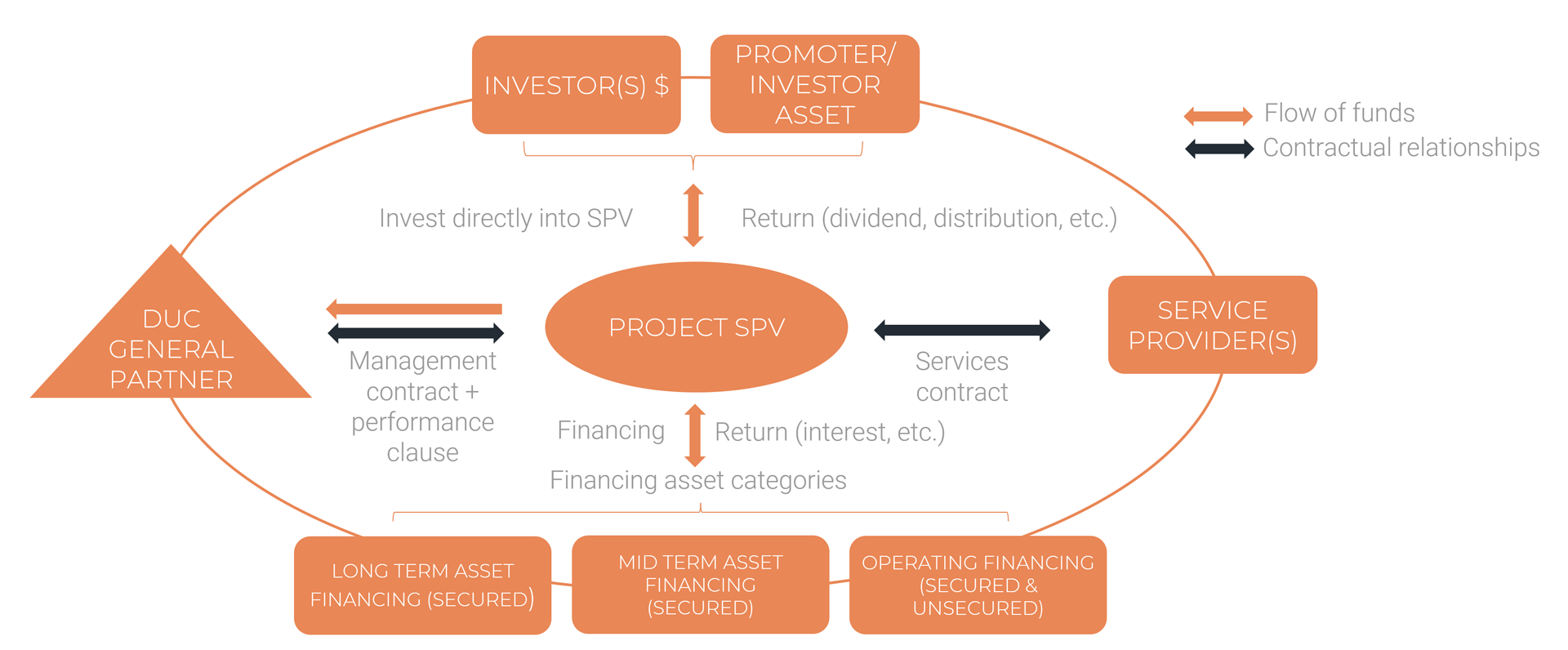

To minimize risks, maximize value and have the ability to implement projects with the right set of financial instruments, we work with communities to democratize the funding. The projects are realized in project investment vehicles that will isolate the risks from the promoters themselves and provide the required governance needed to have sustainable ESG investments with the communities. The value created in these projects is shared between the various financial stakeholders but also with the promoters and the communities making it a sustainable model where everyone benefits from the value created and it incentivizes usage of the infrastructure and minimizes churn.

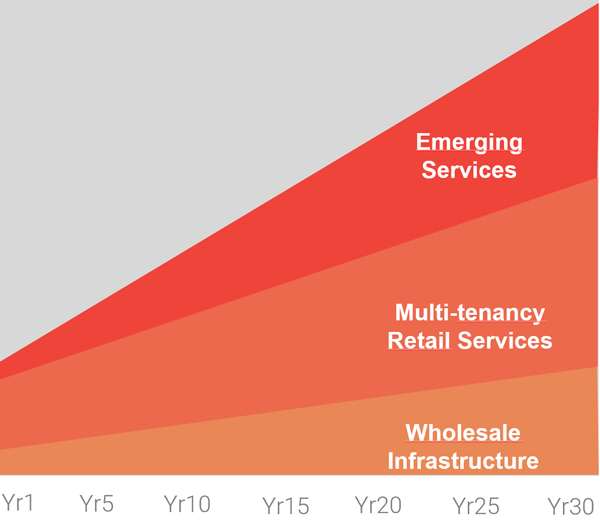

Projects create value from wholesale services, multi-tenancy, shared infrastructures and also emerging services where they can be applied to the communities. These additional revenue streams lower the costs of connectivity by bringing the population to the cloud instead of trying to bring the cloud to the edge.

Improve financial performance of the infrastructure beyond the traditional triple-play services transport revenue by allowing multiple tenants to share infrastructure and promote emergence of new services.

Financial Instruments

Using special purpose vehicles for the implementation and governance of projects allows to segment the different financing instruments according to the categories of assets to be financed. This segmentation then allows to define the optimal capital structure for each project as well as to minimize the weighted average cost of capital for the entire project, two essential conditions to be met particularly for projects in rural areas.

INDIVIDUAL CONTRIBUTIONS FROM COMMUNITY MEMBERS

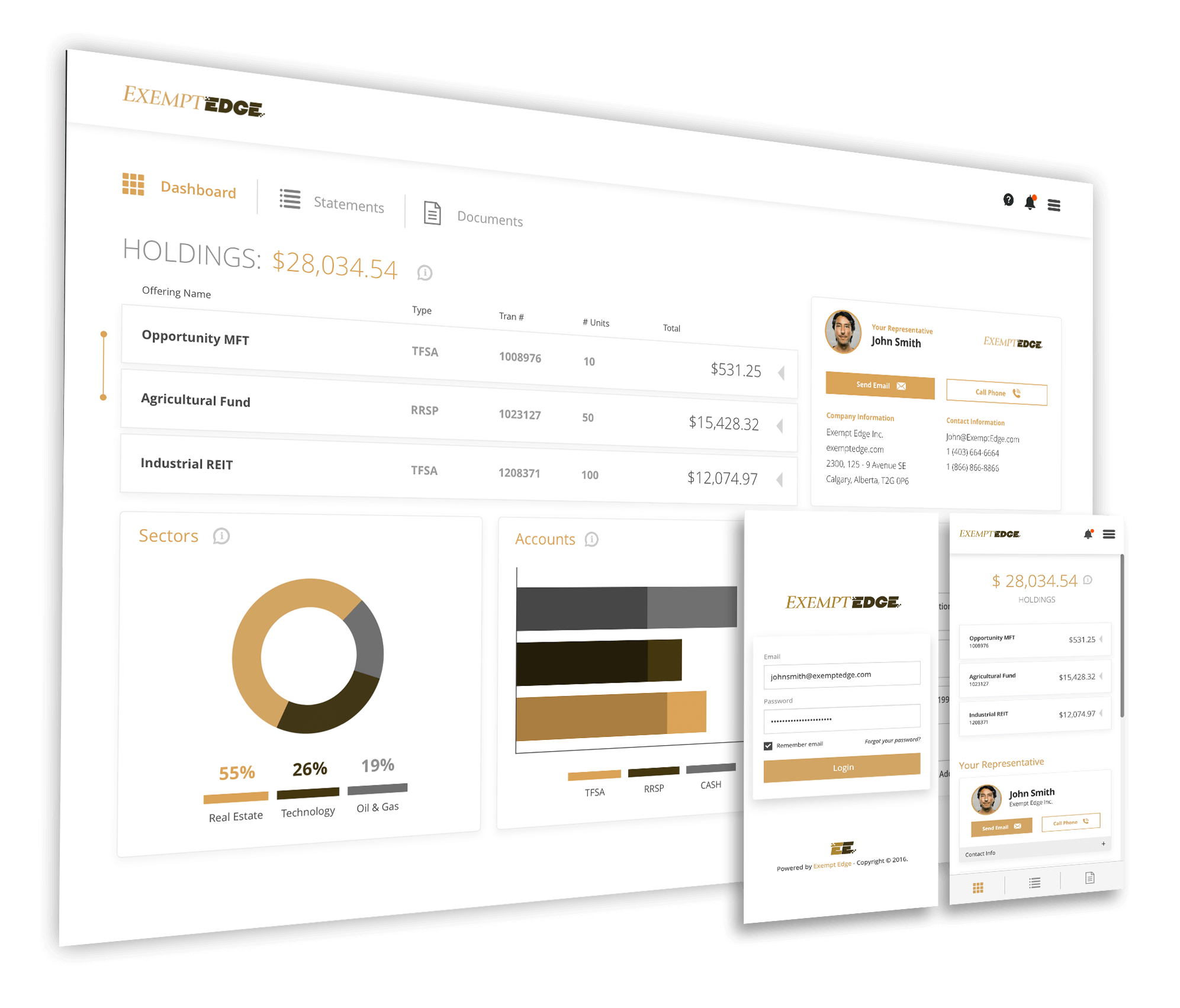

We have been partnering with ExemptEdge as part of the UbiFolio investment performance and management platform. This platform allows individuals to see their portfolio of investments from the Exempt Market Dealer (EMD) emissions in the various project vehicles created. This allows for constant reporting on the yield and payments from these project placements along with realtime performance tracking of the investments.

Manage your Portfolio in our Projects

- Monitor Project Performance in Realtime

- Limited trading of securities when available

- Manage the yields and dividends

Diversify the Investment in Projects

Invest in your Community

Learn how to become a financial connectivity partner and have an impact in your community